The IRS will then return the documents in the envelope provided by the applicant. You can file Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with your federal income tax return. You must also include original documentation or certified copies from the issuing agency to prove identity and foreign status. If questions 11 through 17 on Form SS-4 do not apply to the applicant because he has no U.S. tax return filing requirement, such questions should be annotated « N/A ».

Q15: Can I submit copies of my identification documents with my Form W-7?

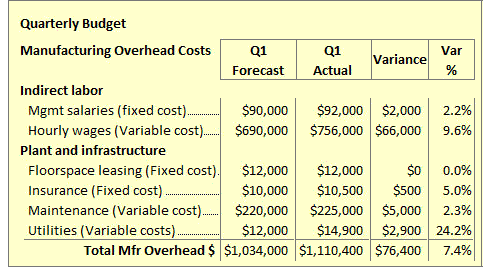

Consider getting certified copies or using one of the application methods listed below, rather than mailing original identification documents to the IRS. You will usually file an ITIN application, Form W-7, Application for IRS Individual Taxpayer Identification Number, with your first tax return, general ledger accounts which you must file as a paper return, not electronically. All the exceptions are listed in the ITIN application instructions. An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441).

What is the difference between a « certified » and a « notarized » document?

Taxpayers with an ITIN can complete the registration process to access their IRS online account, which provides balance due, payment history, payment plans, tax records, and more. The IRS also announced today that compliance efforts around erroneous ERC claims have now topped more than $2 billion since last fall. This is nearly double the amount https://www.quick-bookkeeping.net/what-is-the-difference-between-supplies-materials/ announced in March following completion of the special ERC Voluntary Disclosure Program (VDP), which the IRS announced led to the disclosure of $1.09 billion from over 2,600 applications. The IRS is currently considering reopening the VDP at a reduced rate for those with previously processed claims to avoid future compliance action by the IRS.

Documents with W-7 for ITIN

You can use the online application, or you can send the application in by mail or fax too. If you’re not sure about how to go about this process, then our blog post on how to obtain an EIN for your LLC should help. Anyone who needs to file a U.S. tax return can get an ITIN, regardless of their U.S. immigration status. To prevent delays, make sure you’ve provided the correct information and sent all the required supporting documentation. Incomplete or incorrect applications may take longer to process.

The advantage to using Certifying Acceptance Agents (CAAs) is that for primary and secondary applicants (like a spouse), the CAA can certify that your documents are original and make copies to send to the IRS. That way, you won’t have to mail your originals or copies certified by the issuing agency. If you need to renew your ITIN, you’ll follow the same process as applying for a new ITIN. However, if you mail in your renewal https://www.kelleysbookkeeping.com/ application, you can simply send along a form W-7 with supporting documents—no need to attach a tax return. Businesses should quickly pursue the claim withdrawal process if they need to ask the IRS to not process an ERC claim for any tax period that hasn’t been paid yet. Taxpayers who received an ERC check — but haven’t cashed or deposited it — can also use this process to withdraw the claim and return the check.

Q12: When an individual renews their ITIN will they retain the same ITIN or receive a new one?

“EIN” stands for “employer identification number.” EINs also are nine-digit numbers, and are formatted as XX-XXXXXXX. The taxpayer Bill of Rights is grouped into 10 easy to understand categories outlining the taxpayer rights and protections embedded in the tax code. A taxpayer who was experiencing a family emergency and needed to travel out of the country with his… Acceptance Agents (AAs) and Certifying Acceptance Agents (CAAs) can help you complete applications.

- An ITIN is a tax processing number, issued by the Internal Revenue Service, for certain resident and nonresident aliens, their spouses, and their dependents.

- The staff can help you complete an application and will submit it for processing.

- Acceptance Agents (AAs) and Certifying Acceptance Agents (CAAs) can help you complete applications.

- Applicants can also submit their W-7 by scheduling an appointment at an IRS Taxpayer Assistance Center while in the United States, or through a Certifying Acceptance Agent either in the United States or abroad.

- If questions 11 through 17 on Form SS-4 do not apply to the applicant because he has no U.S. tax return filing requirement, such questions should be annotated « N/A ».

LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List. Acceptance Agents are entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs. They review the applicant’s documentation and forward the completed Form W-7 to IRS for processing.

This is used by individuals who are required to have a US taxpayer identification number. However, they aren’t eligible for a Social Security Number (SSN) from the Social Security Administration (SSN). To apply for an ITIN, complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. Low Income Taxpayer Clinics (LITCs) are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS.

You will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete. As the additional IRS processing work begins at a measured pace, other claims will begin being paid later this summer following a final review. This additional review is needed because the submissions may have calculation errors made during the complex filings. For those claims with calculation errors, the amount claimed will be adjusted before payment. Knowing details regarding an ITIN vs EIN ensures that you don’t waste time and apply for the right identification number. And as a result, you’ll have proper tax filing and compliance with IRS regulations.

Answers do not constitute written advice in response to a specific written request of the taxpayer within the meaning of section 6404(f) of the Internal Revenue Code. The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers’ rights. We can offer you help if your tax problem is causing a financial difficulty, you’ve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isn’t working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you. A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws.

The ERC program began as a critical effort to help businesses during the pandemic, but the program later became the target of aggressive marketing well after the pandemic ended. Some promoter groups may have called the credit by another name, such as a grant, business stimulus payment, government relief or other names besides ERC or the Employee Retention Tax Credit (ERTC). Foreign buyers and sellers of U.S. real property interests need Taxpayer Identification Numbers (TINs) to request reduced tax withholding when disposing of the property interest, and to pay any required withholding. Individuals who do not qualify for Social Security Numbers may obtain Individual Taxpayer Identification Numbers (ITINs) to meet the requirement to supply a TIN.