The federal government keeps launched an initiative to aid people in going into the housing industry the very first time from the underwriting home finance having first homebuyers. The government strategy to possess first time customers allows recognized people to take out a mortgage with just a good 5% deposit and avoid using loan providers home loan insurance coverage.

Earliest Home loan Put Program (FHLDS) standing to own 2022

Pleasing develops have been launched on 2022-23 Federal Budget, making it possible for a great deal more earliest home buyers accessibility it scheme! The original Mortgage Deposit scheme has already been theoretically rebranded the original Domestic Guarantee and you may off , what number of positioning for the lowest deposit plan increases to help you fifty,100000 locations. Next three year months what number of placements will return in order to 35,100 a year.

- thirty five,000 locations a-year into the Basic Domestic Ensure (earlier Earliest Mortgage Deposit Plan) to have eligible first homebuyers hit the market having good 5% put with no LMI.

- 5,100000 urban centers a-year for the newly revealed Regional Domestic Make sure to have eligible home buyers to get a unique domestic for the a great local area that have an excellent 5% put no LMI.

- 10,000 metropolitan areas a year into the Family home Make certain having qualified single mothers to invest in a home having a 2% put with no LMI.

What’s the Earliest Home Verify (Previously Earliest Financial Put System)?

The newest government’s scheme is designed to make it convenient and shorter supply for the property as the Very first Mortgage Put Plan (FHLDS) – now rebranded The first Home Verify 1 – allows first-time consumers the opportunity to buy a property that have in initial deposit off as low as 5%, when you find yourself to stop lenders’ mortgage insurance rates (LMI). Really financial institutions and you will lenders wanted the very least deposit regarding 20% of property’s really worth towards the debtor to get excused of LMI. The newest program lets basic homebuyers which cannot started to this threshold to get that loan if they have stored at the least 5% of the value of the house or property they are to buy. The federal government usually underwrite the borrowed funds making sure that borrowers do not need to pay LMI.

How does they work?

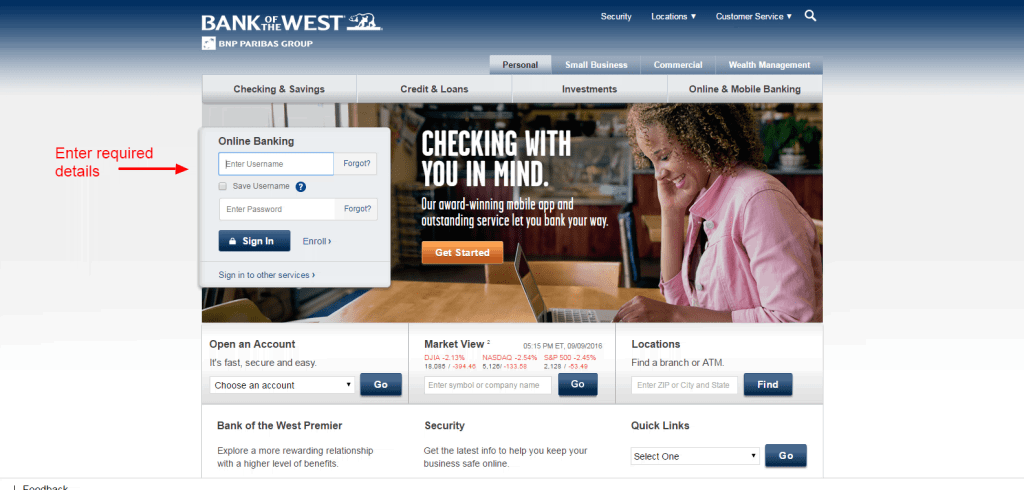

Attempt to sign up for the newest scheme as a consequence of certainly one of the fresh new scheme’s using lenders, or authorised agents such as for instance a home loan Alternatives representative and you may demonstrated your own qualification. When you are acknowledged, then you can take-out home financing having a loan provider and also the regulators will act as your guarantor. Regardless of if your own bank have a tendency to however manage the normal checks on the financial predicament, this will make it simpler to get a loan devoid of spared to have a beneficial 20% put.

Usually, when the a lender chooses to agree financing having a deposit from less than 20%, they’ll have to have the debtor to pay what is named loan providers personal loans Richmond MO no credit check financial insurance (LMI). This is a variety of insurance rates that the lender takes out in order to shelter the risk of this new debtor being not able to settle the loan. Because government was helping because the guarantor on mortgage, you don’t have on lender to obtain insurance coverage. LMI can be quite costly, with respect to the sized the newest put, the size of the mortgage, while the regards to the lending company. The us government states you could conserve to $10,100 towards LMI, however the amount you truly save will be influenced by the fresh particulars of your loan. In addition to, should you have in earlier times planned to save your self having a 20% deposit, you will not experienced to expend LMI, anyway.

By taking aside a home loan within the design, you may then located service up to their loan’s equilibrium try less to help you less than 80% of your property value your home from the pick. But not, for folks who refinance the loan, offer your residence or get-out, you will no longer be eligible for service. We f you are refinancing your house and you nevertheless owe more than 80% of one’s value of the home, you’ll likely need to pay the price for lenders’ home loan insurance policies together with your the fresh new lender.