This involves monitoring updates from tax authorities and engaging the services of tax professionals to ensure compliance with tax laws and regulations. To ensure business success, it’s essential to conduct regular financial analysis and reporting. This involves evaluating financial data to identify trends, performance, and areas for improvement.

Marketing Fee Payments:

The company offers state-of-the-art tax preparation, free e-registration with payment of tax preparation, and all banking products such as outstanding loans. In Tax, Daniel Ahart uses the latest technology to respond quickly to changing market demands and provide customers with the most advanced products and services. Headquartered in Greenwood Village, Colorado, Payroll Vault Franchising is a full-service entrepreneur for small businesses. Payroll Vault gives you the ability to start your own small business backed by its team of experts with years of experience supporting payroll and small business success.

Navigating the Complex Landscape of Franchise Accounting: A Comprehensive Guide for Franchisees

Proper accounting practices are vital for managing expenses and ensuring the success of a franchise. Franchise owners must effectively track their costs, including startup expenses, marketing fees, and payroll costs, to maintain a healthy cash flow. Accurate bookkeeping is essential for meeting financial reporting requirements and adhering to legal obligations. H&R Block Tax Services LLC franchisees prepare tax returns and may be eligible to offer accounting, payroll and training services. Using online accounting can help franchise owners and franchisors communicate about the business’s finances.

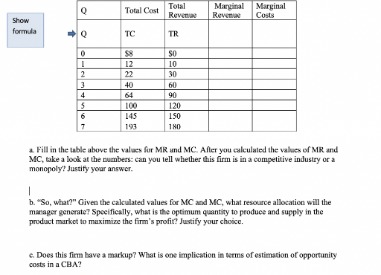

Financial Requirements

Franchise agreements often require franchisees to contribute to marketing funds. Accounting processes should be established to track and manage these fees, ensuring their proper allocation and appropriate use to promote the brand and support marketing initiatives. Franchise owners are typically required to pay ongoing royalty fees to the franchisor, which is a percentage of their revenue.

Having a clear budget is the best method to assure a healthy cash flow.

This ensures consistency and uniformity across all franchise locations, strengthening the overall brand image. Compliance with tax laws and regulations https://www.intuit-payroll.org/ is essential to avoid penalties and fines. It’s important to stay updated on changes in tax laws that may impact the franchise business.

- All businesses have certain things in common, like overhead costs, revenue, and profits.

- Grant Thornton LLP is one of America’s largest audit, tax and advisory firms.

- This is not an opportunity to purchase a franchise; only franchisors registered with and approved in the relevant state can offer such options.

- Both franchisees and franchisors have specialty accounting needs atypical to other types of businesses (described below).

- The franchisors of the company provide all the necessary training on how to handle the finances and how to run the franchise.

Most franchise businesses will include these accounting tasks in order to achieve success. With a dedicated franchise practice for over 35 years, Citrin Cooperman has serviced and worked with some of the largest franchise successes, within a vast array of diversified concepts. The practice works closely with the owners, operators, controllers and CFOs of a wide range of franchisors, helping them establish their brand, and growing their businesses to the next level. Building on more than 175 years of service, Deloitte and their network of member firms spans more than 150 countries and territories.

Depending on the contract, franchise agreements typically last between five and 30 years, with serious penalties if a franchisee violates or prematurely terminates the contract. There were 790,492 franchise establishments in 2022 that supported the U.S. economy, with an expected 805,436 for 2023. In the food sector, franchises included recognizable brands such as McDonald’s, Taco Bell, Dairy Queen, Denny’s, Jimmy John’s, and Dunkin’. Other popular franchises include Hampton by Hilton and Days Inn, as well as 7-Eleven and Anytime Fitness.

They go beyond the expected to make business more personal and build trust into every result. Franchisee compliance tracking is another service you’ll want to look for in an accounting partner. This will help you stay on top of regular reporting requirements as a franchisor. Local bookkeepers might be able to manage a franchise’s financials while they’re at one or two locations. However, if you’re planning to grow your business, you might want to find a different partner.

This gives franchisors the most accurate data to benchmark and forecast performance at the unit and multi-unit level. In addition to the needs of single-unit franchisees, multi-unit franchisees require levels of visibility to accurately capture their https://www.accountingcoaching.online/what-is-my-state-unemployment-tax-rate/ full financial picture. Not altogether, but you may find some of the rules and restrictions of being a franchisee a drawback. Starting from scratch means going about all of that on your own, which is harder but also gives you more freedom.

Together, Deloitte’s more than 330,000 people worldwide make an impact that matters. The franchising industry is handled by their consumer division, which includes both products and services. One of those reporting requirements is creating the Item 19 for your annual Franchise Disclosure Document. The Item 19 informs the reader about the financial performance of existing franchised units. A meaningful I19 is an important aspect of franchisor accounting as it will impact both the short and long-term success of your brand. Franchisors are in the unique position of being responsible for the overall health and reputation of a brand while supporting of all the individual franchisee owners.

Here are a few of the top benefits for those who decide to own an accounting and financial services franchise instead of going at it alone. The franchise profiles on our website will present you with a basic range for the initial investment or minimum cash required to open a franchise. But standard costing: a managerial control tool when it comes to finding out the details of an initial investment, the franchise disclosure document is the best place to look. Franchisors offer itemized estimates in their franchise disclosure document (FDD) based upon their experience establishing, and in some cases operating, units.

As a franchisee, you are given the authority by the franchisor to conduct commerce in accordance with their guidelines and established business model. Managing the finances of a master franchise can be complex, as the franchisee has to oversee the accounting process for multiple franchisees. However, this model provides a significant opportunity for growth and expansion, as the franchisee can benefit from the revenue generated by multiple franchise units.